How to Use the Pivot Point Indicator Trading Strategy and Tips

If you’re interested in having a go-to cheat sheet for trading, this guide has got you covered. If the price is above the central pivot, it’s generally considered bullish; below it, bearish. Pivot points offer a range, a framework to predict potential movement. In the trading realm, a pivot point is a technical indicator derived from the high, low, and closing prices during a particular time frame — be it daily, weekly, or monthly.

Market, pivot points will automatically plot on the daily basis plot. This trade worked itself out well, after continuing the downtrend shortly thereafter. After that point, the market became firmly bearish and fell steadily, showing no sensitivity to pivot points. Below is a view of how they appear on a one-hour chart of the AUD/JPY currency pair. Going a step farther, we calculated the number of days that the low was lower than each S1, S2, and S3 and the number of days that the high was higher than each R1, R2, and R3.

Learn to Trade

To fully harness this technical indicator in your trading strategy, it’s essential to understand where it triumphs and where it can fall short. Traders employ pivot points and the support and resistance levels they establish to identify possible entry and exit points, both for stop-losses and profit-taking. • Yes, pivot points can be used for day trading as well as swing trading. Day traders often use pivot points to identify key levels for entry and exit points in intraday trades.

These products may not be suitable for everyone, and it is crucial that you fully comprehend the risks involved. Prior to making any decisions, carefully assess your financial situation and determine whether you can afford the potential risk of losing your money. In this article, we will explore how to trade multiple time frames and how not to overwhelm yourself in this multi-dimensional view. If you are able to identify the right level of confluence across…

Pivot Points Trading Strategy:

The best way to trade a breakout strategy is when a new trend is emerging. Breakout trades work even better during the more volatile periods in the market, such as after the release of high-impact news and the periods around a market open — London or New York open. These levels are often monitored by many traders, and there are many stop orders, including stop loss orders, lying around them. So, when a breakout occurs, the price usually moves very quickly. Notice how the price was oscillating around one of the pivot levels. As with the stop loss orders, the pivot point indicator levels can also be used as a guide for placing take profit orders.

Jackson Hole: the pivot point for the week? – ig.com

Jackson Hole: the pivot point for the week?.

Posted: Thu, 24 Aug 2023 07:00:00 GMT [source]

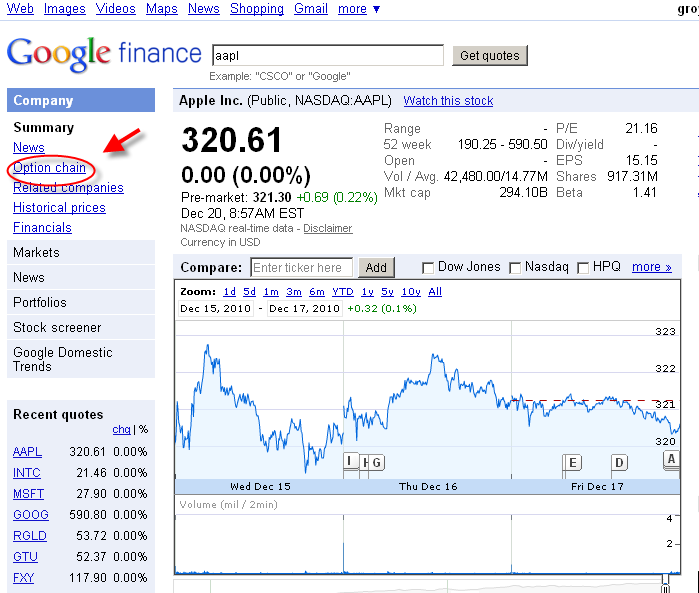

Most charting software will allow you to select whether you want to see the current day’s pivot points or if you would like to see pivot points from prior days. This does not mean you need to run for the hills, but it does mean you need to give the right level of attention to price action at this critical point. If you are a trader just starting out with pivot points and want to get a handle on things, you will want to start with these large-cap stocks. Once you get a handle on things, you can always progress to the penny stocks.

Can Pivot Points Improve My Trading Performance?

The other support and resistance levels are less influential, but they may still generate significant price movements. We can use daily pivot points to identify the next day’s potential range or supports and resistance. Similarly, the weekly pivot is done at the end of every week and the same goes for the monthly pivot. Absolutely, experienced traders often use the Pivot Point indicator in their technical analysis toolkits.

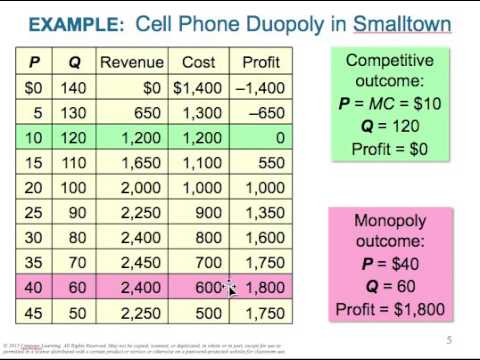

There are 4 support and resistance price levels around the pivot. Price action trading is based purely on price rather than its derivatives such as technical indicators. Price is what is happening right now and is either leading or coinciding but never lagging. Price action is all about detecting patterns and finding support and resistance levels. One way to do this is through simple mathematical calculations referred to as Pivot Points.

- Traders and market makers have been using pivot points for years to determine critical support and/or resistance levels.

- Notice a pullback to the pivot point (P), which coincidentally formed a confluence with the moving average line.

- You achieve much better results when combined with other relevant trading tools.

- The pivot point strategy doesn’t require significant trading capital.

- Pivot points also enable trend and breakout traders to spot key levels that need to be broken for a move to qualify as a breakout.

Those three levels below the pivot point are referred to as support 1, support 2, and support 3 or S1, S2, and S3 for short. Pivot points are most widely used by day traders though they can also offer valuable insight for swing traders and long-term investors. Last but not least, we also need to define a take profit level for our pivot point strategy which brings us to the last step. The next important thing we need to establish for our day trading strategy is where to place our protective stop loss. If during the trading day the market has established a strong bias above (below) the central pivot point we should expect any retest of the central PP to provide a rejection. The close of the day is regarded as the most important price of all OHLC prices.

Pivot Point Trading Guide

Then multiply the previous days’ range with the Fibonacci ratio. Lastly, you have to add the result to the pivot point to determine the resistance levels, and you have to subtract the result from the pivotpoint to calculate the Support levels. Below is a picture of how they look on a 1-day timeframe called the monthly pivot point.

Maybe your entries are solid but you always have sellers remorse. You should always look to clean off your trade slightly below that level. You can just as easily invest in a stock that has the wind to its back and you can ride the wave higher. A stop loss order should be placed above the R3 level as shown on the chart. This will allow you to trade with confidence and the flow of the market. Feel free to watch our free tutorial on Pivot Points by in-house daytrading expert, Al Hill.

However, they typically combine it with other indicators and tools to gain a comprehensive market view and make well-informed trading decisions. In fact, this is the most fundamental use of the Pivot Point Indicator. Another strength of the indicator is that it is very compatible with other indicators. When this happens, you should enter a buy position when price action dips to a support level and subsequent candlesticks show an upturn in events.

Different Kinds of Pivot Points

Traders look for prices to break through identified support/resistance levels as a sign of new trends developing and a chance for quick profits. A great number of trading strategies rely on support/resistance lines. A pivot point is used to reflect a change in market sentiment and to determine overall trends across a time interval, as though they were hinges from which trading swings either high or low. Originally employed by floor traders on equity and futures exchanges, they now are most commonly used in conjunction with support and resistance levels to confirm trends and minimize risk.

Support and resistance lines are a theoretical construct used to explain the seeming unwillingness of traders to push the price of an asset beyond certain points. If bull trading appears to rise to a consistent level what is an advantage to using a multi-step income statement prior to stopping and retracing/reversing, it is said to have met resistance. If bear trading appears to hit a floor at a certain price point before consistently trading up again, it is said to have met support.

$691,000 PERP Deposit by Perpetual Protocol Foundation Amid 31 … – Captain Altcoin

$691,000 PERP Deposit by Perpetual Protocol Foundation Amid 31 ….

Posted: Wed, 06 Sep 2023 15:00:04 GMT [source]

But as aforementioned, getting to the outermost levels, like S3 and R3, is generally rare. A level of resistance forms shortly after the trade begins moving in our direction. Naturally, expecting resistance to form there again in the future can be reasonable. Take trades upon a secondary touch of the pivot level after first affirming that the primary touch is a rejection of the level.

How to attach pivot points to your chart

The best time to trade the pivot points strategy is around the London session open. However, it can be used for the New York session open with the same rate of success. The pivot point strategy doesn’t require significant trading https://1investing.in/ capital. We’re going to show you what the best method is to trade pivot points through our best pivot point strategy PDF. Without further ado, let’s see how you can efficiently trade following the best pivot point strategy PDF.

As an option, you could sell out at the next resistance level up. You might be leaving money on the table, but there is a greater risk of being greedy and looking for too much in the trade. At first glance, it’s easy to want to focus on the current day levels as it provides a clean chart pattern; however, prior days levels can trigger resistance on your chart. If your position is sitting below or right around the breakout level 30 minutes after entering the trade – the stock is screaming warning signals. The beautiful thing about higher float stocks is that these securities will adhere to and trade in and around pivot point levels in a predictable fashion.

Notice: Undefined index: img in /home/new.lvinpress.com/public_html/wp-content/plugins/molongui-authorship/public/views/parts/html-author-box-avatar.php on line 4

Notice: Undefined index: show_social_web in /home/new.lvinpress.com/public_html/wp-content/plugins/molongui-authorship/public/views/parts/html-author-box-socialmedia.php on line 6

Notice: Undefined index: show_social_mail in /home/new.lvinpress.com/public_html/wp-content/plugins/molongui-authorship/public/views/parts/html-author-box-socialmedia.php on line 7

Notice: Undefined index: show_social_phone in /home/new.lvinpress.com/public_html/wp-content/plugins/molongui-authorship/public/views/parts/html-author-box-socialmedia.php on line 8

Notice: Undefined index: type in /home/new.lvinpress.com/public_html/wp-content/plugins/molongui-authorship/public/views/parts/html-author-box-name.php on line 20

Notice: Undefined index: type in /home/new.lvinpress.com/public_html/wp-content/plugins/molongui-authorship/public/views/parts/html-author-box-name.php on line 21

Notice: Undefined index: type in /home/new.lvinpress.com/public_html/wp-content/plugins/molongui-authorship/public/views/parts/html-author-box-name.php on line 22

Notice: Undefined index: name in /home/new.lvinpress.com/public_html/wp-content/plugins/molongui-authorship/public/views/parts/html-author-box-name.php on line 44

Notice: Undefined index: bio in /home/new.lvinpress.com/public_html/wp-content/plugins/molongui-authorship/public/views/parts/html-author-box-bio.php on line 21